Who We Are?

Our Mission

Building an Asset Backed Secure Digital Currency for the Energy and Conductive Metal Industry Sectors (RWA) Real World Assets

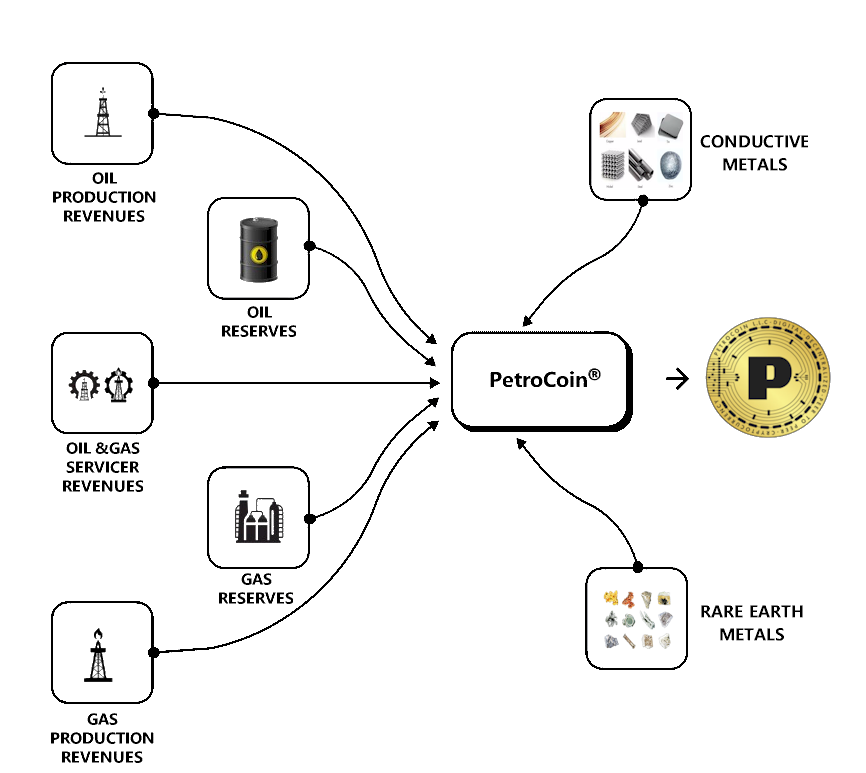

PetroCoin® is an asset backed security token being issued by PetroCoin Limited Liability Company and is compliant with the Ethereum’s ERC20 protocol blockchain standard and falls under the Reg D Exemptions of the U.S. Securities and Exchanges regulations. The token derives its value from the value of proven oil and gas reserves, production, service company revenues and conductive and rare earth metal assets. These are the assets held by the “$PTCN” Petrocoin® blockchain token. “Digital Liquid Gold”

In the vast realm of commodities, few substances hold as much significance and economic value as oil. It’s the lifeblood of the modern world, fueling industries, transportation, and economies. In a similar way, conductive and rare earth metals have just as much influence in life’s daily activities. Without Conductive or Rare Earth Metals, computers, cars and electronic equipment in general could not function. However, amidst these valuable resources lies an opportunity for innovation and efficient management – asset tokenization. The fusion of blockchain and the oil and conductive and rare earth metal industries will ignite a new revolutionary era, changing investment methods in two of the world’s most lucrative sectors, oil, gas, oil services and conductive and rare earth metals. Welcome to the age of unlocking “digital liquid gold” through tokenization.

What are Real World Assets (RWAs)

Real-world assets (RWAs) in blockchain are digital tokens that represent physical and traditional financial assets, such as currencies, commodities, equities, and bonds.

Real-world asset (RWA) tokenization is one of the largest market opportunities in the blockchain industry, with a potential market size in the hundreds of trillions of dollars. In theory, anything of value can be tokenized and brought to the blockchain.

What is Tokenization?

Tokenization is the process of converting rights to an asset into digital tokens on a blockchain. These tokens represent ownership, a share, or the value of the underlying asset. Essentially, tokenization enables the division of a single asset into smaller, tradable units, providing liquidity and accessibility to a broader range of investors.

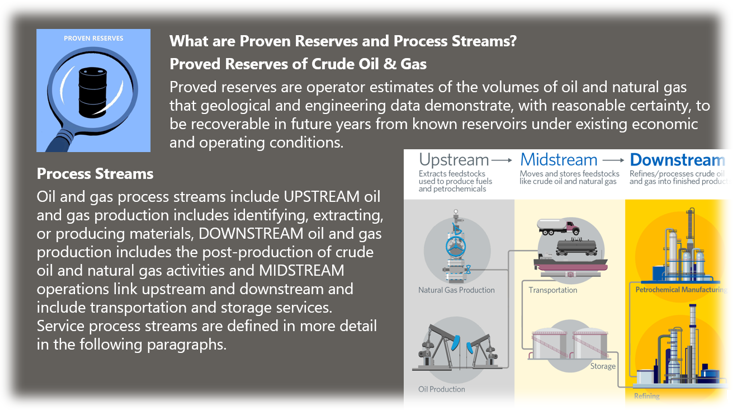

Why Tokenize Oil and Gas Proven Reserves, Process Streams Conductive and Rare Earth Metals?

Let’s explore the compelling reasons why tokenizing oil and gas proven reserves is a game changer in the global market not to mention the tokenization of oil and gas service company’s revenue streams and conductive and rare earth metals. While the oil and gas production industry represent a multi-trillion-dollar annual business, the oil and gas service industry produce in excess of hundreds billions of dollars annually also. Adding conductive and rare earth metals to our basket of assets is yet another stabilizer to our asset portfolio provided an additional multi-trillion dollar market opportunity adding these additional assets.

Global Access:

Tokenization opens up the oil and gas production and service markets to a global audience, enabling investments from anywhere around the world. Digital tokens can be traded 24/7 on online platforms, transcending geographical limitations.

Enhanced Liquidity:

Traditional investment in oil and gas and conductive metals often involves high entry costs and liquidity constraints. Tokenization divides oil assets into smaller, tradable units, providing investors with enhanced liquidity and the ability to buy and sell fractions of proven reserves easily.

Portfolio Diversification:

To enhance portfolio diversification, PetroCoin® designates what we refer to as “Asset Baskets” for Fractional ownership of oil and gas assets. These Asset Baskets include Royalties, Working Interest, Power Generation, Services, Infrastructure and Conductive and Rare Earth Metals. PetroCoin’s use of the ERC-20 Blockchain environment in its basic investment strategies allow token holders to fractionalize their token ownership and diversify their portfolios without having to commit to entire field projects. This diversification helps in risk mitigation and aligning with different investment strategies.

The Impact of Tokenization

Market Dynamics:

Tokenization introduces transparency and efficiency to the oil and gas markets by leveraging blockchain technology. The immutable and auditable nature of the blockchain ensures a clear record of transactions and ownership, reducing fraud and enhancing market integrity.

Breaking Barriers:

Traditional barriers to entry, like minimum investment amounts and regulatory restrictions, are significantly reduced. Tokenization promotes inclusivity, allowing a broader range of investors to participate in the oil market.

Financial Inclusion:

Tokenization modifies or changes access to oil investments, making it feasible for smaller investors to venture into the oil and gas markets. Fractional ownership ensures that even those with limited capital can have a stake in this valuable commodity.

A CLOSER LOOK AT THE PETROCOIN® ECONOMICS

The Technical Side

Understanding PetroCoin® Token

PetroCoin® represents a groundbreaking integration of blockchain technology with the oil and gas industry. It involves converting physical proven reserves of oil and gas and service revenue streams along with conductive and rare earth metals into digital tokens, each token denoting a specific fraction of the actual oil, gas and metal values.

The quick presentation below provides more technical information on how our private blockchain trading platform, PetroCoin® token works.

- Allows for the new issuance of Secure Tokens

- Allows for secondary trading of Secure Tokens

- Allows for settlement of Secure Tokens

Our PetroCoin® Token

Understanding Petrocoin®

The Make Up of a Solid Asset Backed Token!

Key Features of PetroCoin®

Fractional Ownership:

Each token literally represents a fraction of an oil barrel or gas cubic foot value or field service revenue stream or bar of gold, copper, silver, or other rare earth metals making it feasible for a broader range of investors to participate in the energy markets.

Redefined Liquidity:

Tokenization enhances liquidity in the oil and gas and conductive metal markets by facilitating the seamless trading of these digital tokens, empowering investors to react swiftly to market dynamics.

Security and Transparency:

Built on a blockchain, the PetroCoin® ensures secure and transparent transactions, allowing for an immutable record of ownership and trades.

Intrinsic Value Backing:

PetroCoin® token assets are supported by independently certified proven recoverable oil and gas reserves, production, service revenues and conductive and rare earth metals which represent a total marketplace in the trillions of dollars in value. PetroCoin’s token pricing is pegged against the energy and conductive metals markets overall, not any one commodity.

Basket of Oil and Gas and Metal Assets:

PetroCoin® tokens are backed by a diversified basket of oil and gas assets, including physical oil and natural gas proven reserves and interests in oil and gas producing fields and process stream revenues and energy processes and conductive and rare earth metals.

Reliable Store of Value:

PetroCoin® is designed to be a safe haven tokenized store of value, offering stability and security amidst market fluctuations and economic uncertainties.

Price-to-earnings ratio (P/E)

What is the Price-to-Earnings Ration (P/E)? P/E Defined here. The PetroCoin® tokens value performance will parallel the public energy sector where P/E ratios range in the 12 to 14 times multiple for valuation share pricing. The PetroCoin® tokens initial P/E will be established by management in a very conservative manner but will eventually more closely reflect the energy sector models as it’s asset base and liquidity grows. See oil and gas P/E sources Citation Here.

Transparent and Compliant:

The PetroCoin® team is fully transparent and committed to legal compliance. They adhere to applicable tax laws, and financial reporting standards, and work with regulators to foster trust and compliance.

Post effects of PetroCoin® token Exchanges

Asset token holders that exchanged production and service assets for PetroCoin® token assets add value to their balance sheet with no upside barriers.

For production companies with values tied directly to a barrel of oil or a mmf of natural gas, the Petrocoin® token assets exchanged will provide additional baseline value to their company with a solid asset backed financial token that brings stability and also transparency to their current financial evaluation.

For producers of working interests, mineral right holders and service companies looking to expand their balance sheets, PetroCoin® provides the perfect financial vehicle to accomplish that task and with the inclusion of conduction and rare earth metals to our basket of assets, this will lend not only additional growth but additional stability to our PetroCoin® token.

Adding PetroCoin® digital assets to your balance sheet is normally treated as an intangible asset for most companies and is recorded at its purchase price, with changes in value reported on the Company’s financial statements. New accounting rules require measuring these assets at fair value, so gains and losses will directly impact your financial statements.

In closing, as the PetroCoin’s token value increases with additional acquisition of solid energy assets, this added value will be reflected in our financial statements. A win-win for everyone!

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  Dogecoin

Dogecoin  Bitcoin Cash

Bitcoin Cash  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Litecoin

Litecoin  Avalanche

Avalanche  Toncoin

Toncoin  Tether Gold

Tether Gold  PAX Gold

PAX Gold  Ethereum Classic

Ethereum Classic  Arbitrum

Arbitrum  Filecoin

Filecoin  Kinesis Silver

Kinesis Silver  Kinesis Gold

Kinesis Gold  Rollbit Coin

Rollbit Coin  Stargate Finance

Stargate Finance  Bounce

Bounce  BounceBit

BounceBit  Comtech Gold

Comtech Gold